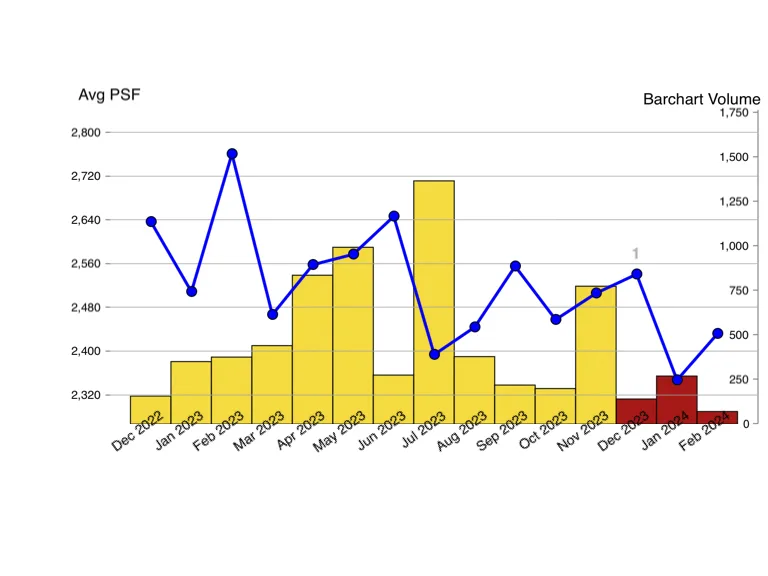

New Condo Launch from Dec 2022 to Feb 2024

Blue trend line connecting the average PSF during new condo launch month

New Condo Launch

As of January 2024, new launch prices stood at $2,356 psf islandwide (exclude EC), reflecting a decrease from $2,513 psf in January 2023. It is important to acknowledge that this observation is made early in the year, and with over 40 launches scheduled ahead, an anticipated increase in the subsequent months is expected. It is crucial to recognize that this is a concise overview, and tracking psf prices month by month may not be the most optimal approach due to the volatility in volumes. Nonetheless, this provides a brief snapshot of the performance of new condo prices since Dec 2022.

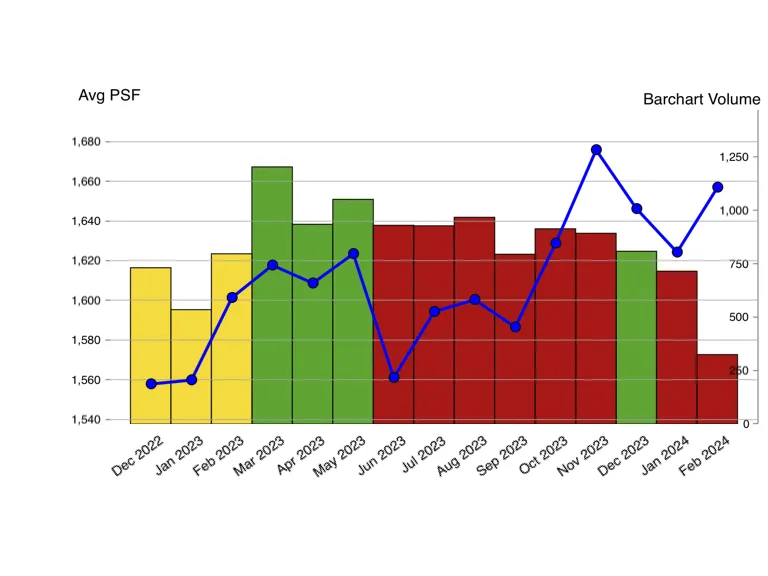

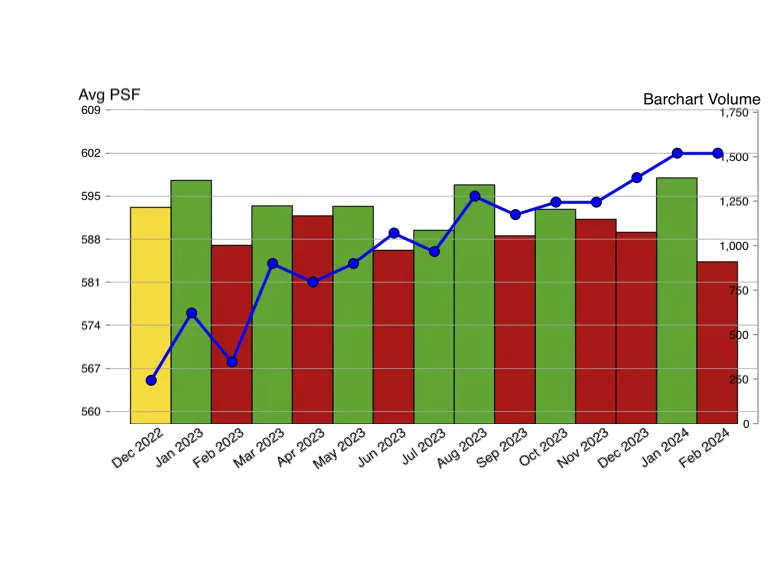

Resale Condo from Dec 2022 to Feb 2024

Blue trend line connecting the average PSF during new condo launch month

Resale Condo

Meanwhile, there has been an increase in resale condo prices, driven by the growing trend of buyers, who are priced out of new launches, turning towards these options:

As of January this year, average resale condo prices stand at $1,626 psf (exclude EC), reflecting an increase from $1,561 psf the previous year. Given the above, an estimated quantum of approximately $2.53 million can be derived for a 1,000 sq. ft. three-bedroom unit in a new launch, while a resale unit of the same size is valued at around $1.62 million.

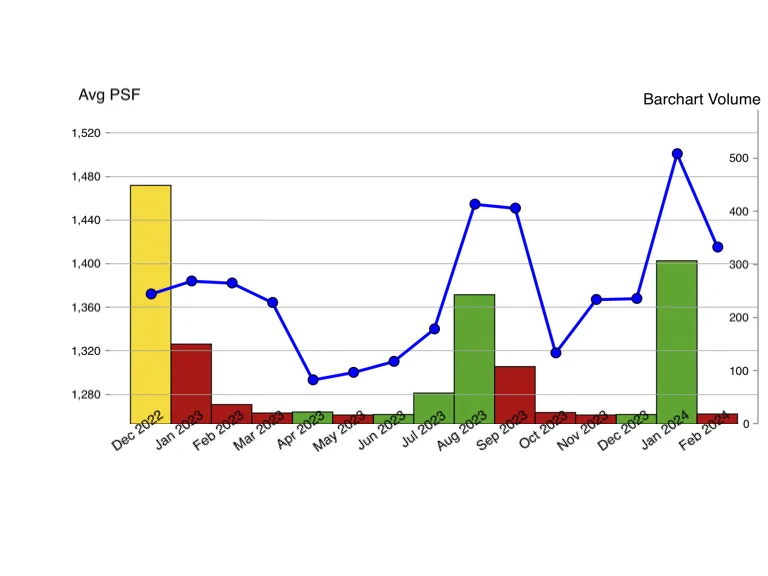

New Executive Condo Launch from Dec 2022 to Feb 2024

Blue trend line connecting the average PSF during new condo launch month

New Executive Condo (EC) Launch

Examining EC (executive condo) new launches at the beginning of 2024, an impressive average of $1501 per square foot (psf) was attained, as compared to $1384 psf during the same period last year. Consequently, an estimated quantum of approximately $1,470,980 million can be associated with a 3-bedroom EC of 980 sqft.

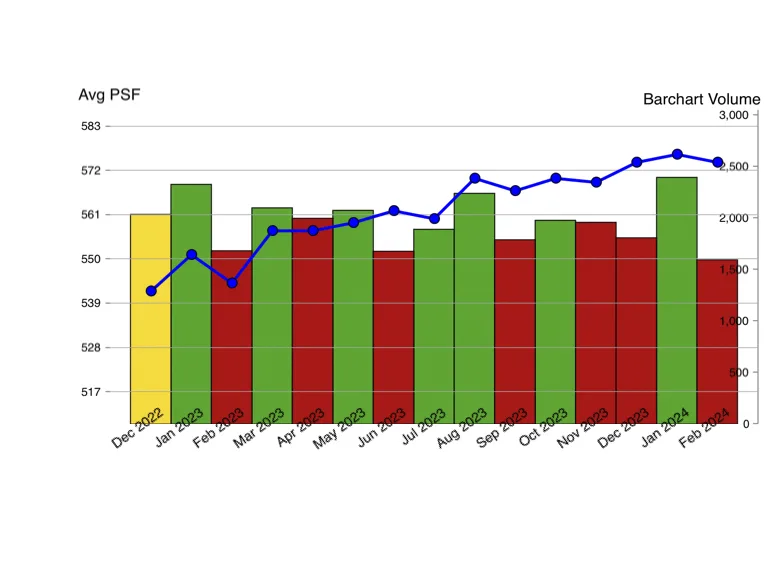

HDB Resale (Unit Size 700 sqft - 1700 sqft) from Dec 2022 to Feb 2024

Blue trend line connecting the average PSF during new condo launch month

HDB Resale (HDB Unit size 700 sqft – 1700 sqft)

As of January this year, HDB average resale prices stand at around $576 psf, reflecting an increase from $551 psf in the previous year. Anticipated levelling off of prices is expected further into the year due to the increased number of completed flats and the ongoing implementation of the Prime and Plus model housing. This may diverge demand from the resale market, attracting buyers uninterested in upgrading.

HDB 4 Room Resale (Unit Size 700 sqft - 1100 sqft) from Dec 2022 to Feb 2024

Blue trend line connecting the average PSF during new condo launch month

HDB 4 Room (Unit size 700 sqft – 1000sqft)

Let’s specifically examine the 4-room flat, widely regarded as the most common type of public housing:

As of January 2024, a median resale price of $520,000 is observed in prices. The typical 4-room flat, spanning around 960 sq. ft. (with variations in some being slightly larger)

So looking at the probable price gaps faced by upgraders today, we have:

A possible gap of over $2 million between a resale 4-room flat and a new launch three-bedder condo. And approximately $1 million price gap when considering upgrading to a new launch EC.

How is upgrading to a condo impacted by the home loan situation in 2024?

Assuming that an upgrader qualifies for the full 75 per cent Loan To Value (LTV) ratio and can secure a loan tenure of 25 years, it’s important to note that under the Total Debt Servicing Ratio (TDSR), the monthly loan repayment must not exceed 55 per cent of their monthly income.

Also, note that the floor interest rate for TDSR calculations is four per cent per annum.

We will also assume our upgraders sell their flat before buying their condo, thus avoiding the Additional Buyers Stamp Duty (ABSD).

For a new launch three-bedder at $2.53 million, our upgrader would need:

$126,500 in cash (the first five per cent of the down payment)

$506,000 in any combination of cash or CPF (the next 20 per cent of the down payment)

Buyers Stamp Duty of $96,100

The total loan quantum after this (75% of the price) would be $1,897,500.

But can an HDB upgrader afford this?

To calculate the affordable to upgrading to a condo or executive condo bigger HDB, use Myhomecal – Affordability, Singapore’s simplest property mortgage calculator. Source: Myhomecal.com

What’s the difference between 2024 and previous years?

The most noticeable distinction is likely to be found in the amounts involved, with regular stamp duty increments in various transaction values. However, setting aside those considerations, there are a few factors that extend beyond the numerical aspects. Firstly, there is a considerable increase in the interest rate compared to previous years. For instance, if the last home purchase was a decade ago, you might have been accustomed to an interest rate of two per cent or below. The noteworthy aspect here is that your home loan interest rate is no longer surpassed by your CPF interest rate (2.5 per cent).

The second distinction lies in the resale market, which offers a more favourable opportunity for upgraders. Naturally, patience is required to find a home that aligns with their criteria. Additionally, there is a reliance on the hope that the bank valuation can align with the seller’s asking price. A notable challenge arises as sellers grapple with reconciling their expectations with the valuations provided by the bank. This is all happening against a backdrop of growing geopolitical issues, from the upcoming US elections, the possible interest rate continues increasing, increasing the influence of BRICS, and how the US economy going to respond.

The original BRICS cohort comprising Brazil, Russia, India, China, and South Africa added substantial new financial firepower and geopolitical clout with the inclusion this month of new Middle East and North Africa (MENA) members Egypt, Ethiopia, Iran, Saudi Arabia, and the UAE. The BRICS bloc now represents more than 45% of the world’s population and accounts for a larger share (nearly 36%) of global GDP than G7 countries (30%) when adjusting for purchasing power parity (PPP). source: Henleyglobal – BRICS Wealth Report 2024