We have completed the 1st quarter of 2024, will there be a break in the upward trend of ABSD on Singapore property this year? what is the property marketing heading in the coming months? Buying a property in Singapore in 2024 is like dancing on a tightrope, navigating a difficult or precarious balance between two opposing forces or circumstances, delicacy, skill, and the potential for failure if not handled carefully.

Let’s dive straight into ABSD on Singapore Property:

- What is the root cause of the problem?

- The Birth of ABSD on Singapore Property

- What exactly is the Additional Buyer’s Stamp Duty?

- How does ABSD work? How home buyers and upgraders are affected?

- Closing Thoughts – Possible U-turn in ABSD on Singapore Property in 2024?

1) What is the root cause of the problem?

The primary cause of this is infamous stamp duties – ABSD (Additional Buyer’s Stamp Duty) and Seller Stamp Duty (SSD). Undoubtedly, ABSD on Singapore Property ranks as the least favoured term among Singaporean home seekers. Implemented in 2009 to temper demand in the residential housing sector, these measures aim to ensure a stable and sustainable property market recovery while maintaining housing affordability for Singaporeans. Notably, this is in addition to the BSD (Buyer Stamp Duty).

These measures have undergone continuous revisions over the years, including changes in loan-to-value (LTV) ratio requirements and Total Debt Service Ratio (TDSR), effectively curbing over-leveraging on bank loans and deterring speculative house flipping. Stamp Duty (SSD) is the actual driver to keep the “get-rich-quick” house purchasers at bay. Seller get tax if they sell their properties during the first 4 years of their purchase.

2) The Birth of ABSD on Singapore Property

Allow me to simplify the ABSD topic into bite-sized pieces for easier understanding.

First, we’ll delve into a concise history of ABSD’s origins, then examine its mechanics and how it affects your transaction costs as a home seeker, regardless of citizenship.

In the most recent year 2007/08 Singapore was hit by the Global Financial Crisis, predatory lending in the form of subprime mortgages targeting low-income homebuyers, excessive risk-taking by global financial institutions, a continuous buildup of toxic assets within banks, and the bursting of the United States housing bubble culminated in a “perfect storm”, which led to the Great Recession. (source: Wikipedia – Singapore in Its Worst Recession for Years. The Effects of the Current Economic Crisis on the City-State’s Economy)

Before this, in 2001 Singapore’s economy last went into a recession, a consequence of economic restructuring in the region that followed the Asian crisis in the late 1990s. But after four quarters of consecutive contraction between the second quarter of 2001 and the first quarter of 2002, the economy recovered and showed strong growth again.

As a consequence, cooling measures were initiated by the government from 2009 onwards to soften the demand for residential housing, thereby ensuring a smooth and sustainable recovery of the property market while maintaining the affordability of housing for Singaporeans.

3) What exactly is the Additional Buyer’s Stamp Duty?

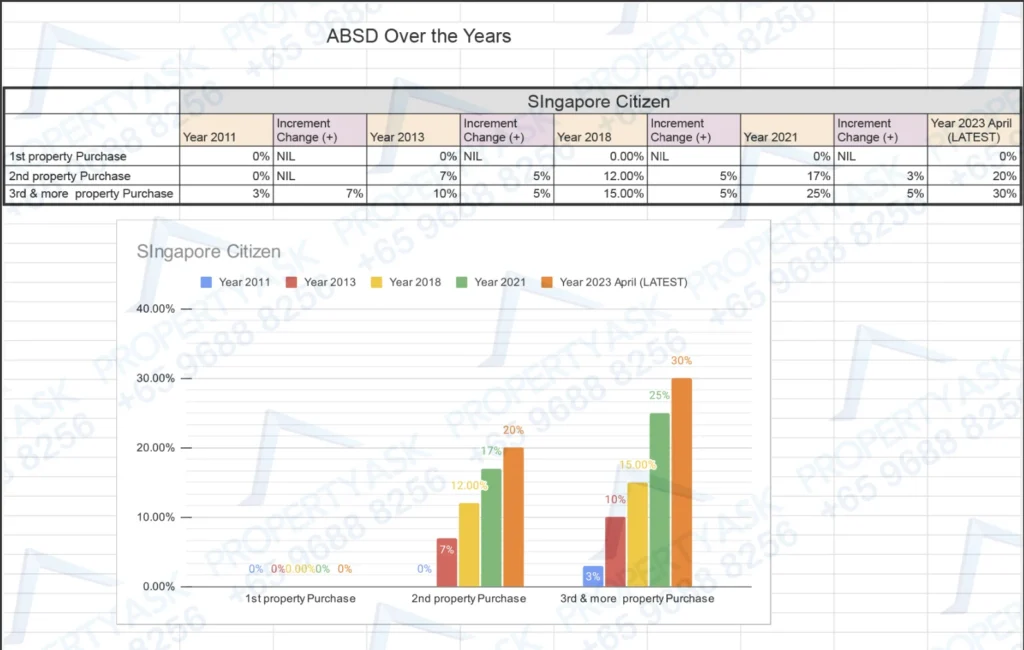

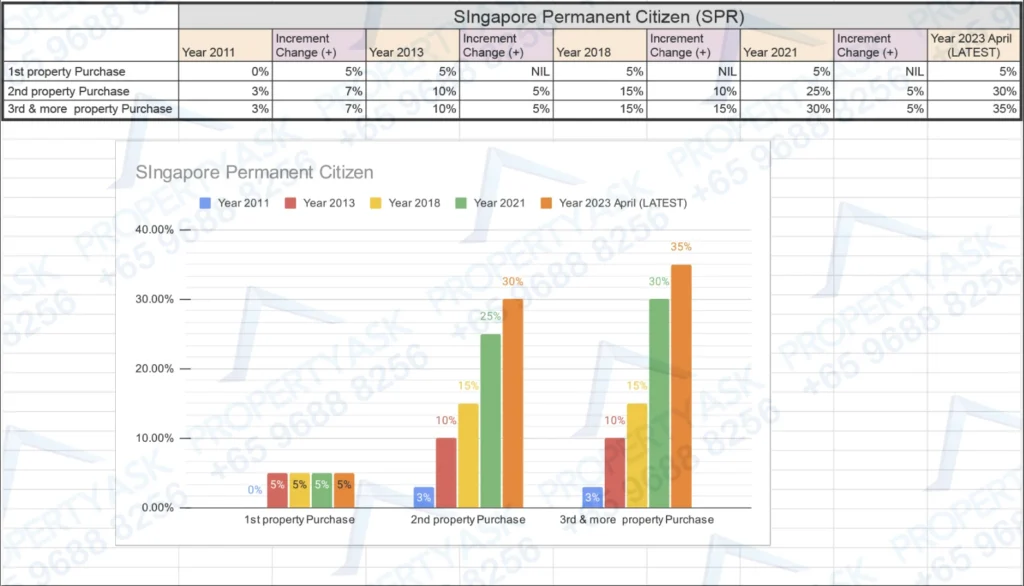

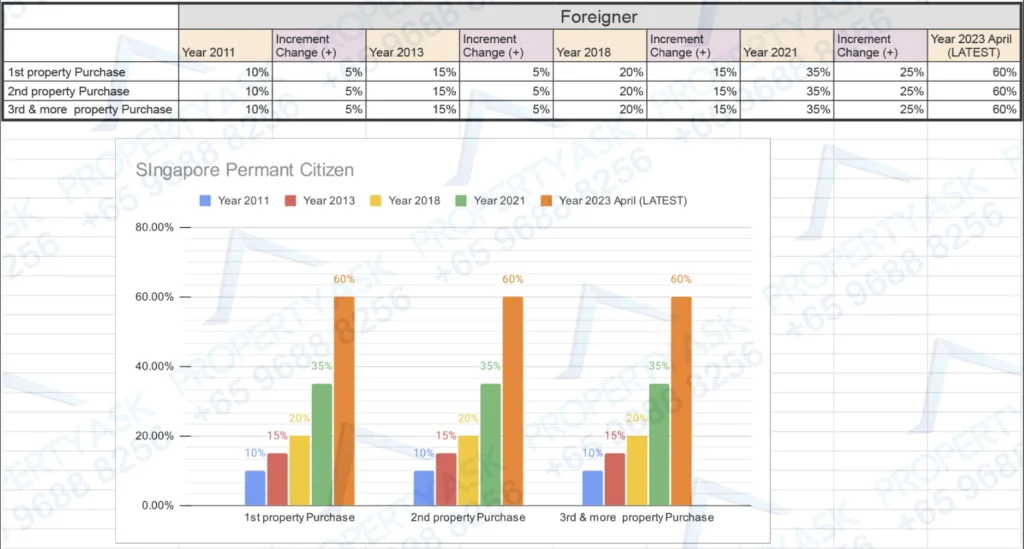

ABSD, introduced on December 8, 2011, is an additional tax levied on top of the buyer’s stamp duty (BSD), payable within 14 days after exercising the Option to Purchase documents. The amount varies depending on citizenship and is calculated based on the higher of the selling price or valuation of the newly acquired property. Home buyers purchasing Building Under Construction (BUC) get the same treatment! – You pay tax before you get your keys to the new property)

Here is the graphical presentation of how ABSD rates have changed over the years:

4) How does ABSD work? How home buyers and upgraders are affected?

The rule of thumb is, that ABSD comes into effect when the buyers are going through the purchasing and still have owned properties under their names.

They are still liable to pay ABSD 1st on their new purchase and claim back later. (be VERY careful, there are many terms and conditions, which I will have another blog on it soon)

5) Closing Thoughts – Possible U-turn in ABSD on Singapore Property in 2024?

A swift response may be forthcoming – yes possible. This naturally reflects my viewpoint. Although a complete abolition appears improbable, there is potential for adjustments, mirroring the recent announcements made in the February 2024 budget. This prospect is particularly plausible given the impending nationwide election. Recent trends in developer and resale market transactions indicate a decrease in transaction volumes, implying potential alterations in the property market dynamics.

Always exercise with caution, “Buying may be easy, Selling is another story”. For further pointers to cater specifically to your needs, contact me.